The Greatest Recovery, Part I

This is a web-only article from Dollars & Sense: Real World Economics, available at http://www.dollarsandsense.org

This article is a web-only article.

Subscribe Now

at a 30% discount.

According to a recent CNN poll, three out of four Americans believe the recession is not over. Unemployment has not been this high for this long in most Americans’ lifetime. By every measure, the U.S. economy is failing to recover from the Great Recession.

Every measure except one.

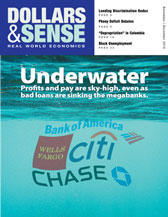

In the last 18-20 months, corporate profits climbed at the fastest pace on record. Non-financial companies are reporting the highest free cash flow (profits after dividends and capital expenditures) in a half-century. Profit margins at S&P 500 companies are now above 9%, approaching uncharted territory. Joseph Lavorgna, chief U.S. economist of Deutsche Bank, stresses, “Not only are we seeing a tremendous V-shaped recovery in corporate profits, but we are in fact seeing the biggest corporate profit recovery ever.”

The Obama recovery is turning the traditional formula on its head; corporate profits have not been a leading indicator of economic recovery, but a lagging indicator of Main St. impoverishment. The Greatest Recovery in corporate profits and the Great Recession are two sides of the same coin.

Worker-advocacy group Change to Win released the results of a recent survey which found that wage stagnation ranks as the most common impact of the Great Recession. Workers will believe in the recovery narrative when they see a raise in their paychecks. For now, productivity gains are going straight to their employers’ bottom line. Andrew Sum, professor of economics at Northeastern University, concludes that the current expansion “has seen the most lopsided gains in corporate profits relative to real wages in our history.”

The Greatest Recovery marks corporate executives’ latest triumph in their decades-long campaign against labor. Since the Reagan expansion, U.S. corporate profits exhibited a permanent tendency to soar at the expense of wages. The top one percent of income earners accrued nearly two-thirds of all economic growth. Profit margins expanded in an unprecedented super-cycle while workers struggled through increasingly lopsided, jobless recoveries. The last three expansions presaged the Greatest Recovery and defined its precise shape.

The unequal distribution of income between profits and wages is ultimately reflective of an unequal distribution of power between business and labor—at the workplace and in Washington.

President Obama signaled his commitment to continuity early on. Despite underestimating the rise of unemployment in late 2008 and early 2009, Obama’s advisors rejected the public employment option swifter than its counterpart in healthcare reform. President Obama initially defended the stimulus on the specific grounds that the private sector would create 95% of the jobs.

Some critics of the plan correctly argued that, given the decline in demand, the stimulus should have been larger. Size was not the only problem. Larry Summers, Obama’s former chair of economic advisors, designed the stimulus to maximize GDP rather than employment—job creation, private sector included, was at best an incidental goal.

Twenty-six million Americans are presently unemployed or underemployed. According to Economic Policy Institute’s Heidi Schierholz, “If the rate of job growth were to continue at October’s rate, the economy would achieve prerecession unemployment rates (5% in 2007) in roughly 20 years.”

The Obama administration’s laissez-faire attitude towards the reeling labor market contrasts sharply with the direct assistance it provided to the financial industry. The two-dozen Treasury and Federal Reserve policies implemented during the financial crisis shared one overriding goal: prevent prices from falling in the real estate, bond, and equity markets. Yet, the Obama administration ignored the Employee Free Choice Act even as the price of labor (wages and salaries) suffered the sharpest decline in 50 years. The administration’s economic policy regime compels workers to the free market while protecting banks from its ruinous fallout.

President Obama’s refusal to resolve the unemployment crisis provides the corporate sector with a crucial, often overlooked, subsidy. High unemployment permits management to extort wage concessions and productivity gains from their anxious employees. An article in the December issue of The Economist explains, “Since the end of 2008 business-sector productivity has grown at an impressive annualized rate of 4.2% while hourly compensation has crept ahead by just 2.1%. Unit labor costs have fallen at an annualized 2% rate, the steepest cumulative decline since the 1950s. Profits owe their V-shape in great part to employment’s L-shape.”

The unemployment crisis qualifies as a national emergency; it’s also the foundation of the Greatest Recovery.

Did you find this article useful? Please consider supporting our work by donating or subscribing.