Jobs in Turbulent Times

Monthly jobs report from the National Jobs for All Network (May 2025 and April Too)

Billionaires John Paulson, Harold "Ice Man" Simmons, and Paul "The Vulture" Singer have dropped more than a million dollars each into the Mitt Romney "Super-PAC" Restore Our Future. As Butch said to Sundance, "Who ARE these guys?"

There is no such thing as a victimless billionaire. In 2012, I set out to uncover how they got their money, why they need to buy a president, and how they intend to do it. And the names of their victims.

The result is a short book, with a comic book inside by Ted Rall, called Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps--An investigation of Karl Rove, the Koch Gang and their Buck-Buddies.

Here's an excerpt from two chapters of the book, about when the sulphurous scent of billionaire Paulson first hit my reporter's nose. It was 2008, when I was working the vote-theft beat for BBC TV and Rolling Stone...

In 2008, at BBC London, I got a call from Detroit, which surprised me because I thought Detroit had died years ago. I was told that banks were foreclosing on tens of thousands of homes; families were being forced from their houses in herds. And as the judge's gavel came down, sealing the foreclosures, something most interesting happened: the foreclosed residents had their names struck from the voter rolls.

It seems the Republican Party had challenged the rights of voters to cast ballots because their addresses were no longer valid, having lost their right to live where they lived. Lose your home, lose your vote. Even if they still lived in the state, or even if they had remained in the house.

What intrigued me was how the GOP got ahold of the names of those facing foreclosure. It was the summer of 2008, the world economy and General Motors had driven off a cliff, and foreclosed voters, even those who had moved away within the state, would have no time to challenge the challenge to their vote--nor even, if they mailed in their ballot, would they know their names had been removed.

American TV just didn't give a shit, not about Black folks losing homes and votes. Those didn't make pretty pictures. But BBC Television Newsnight told me to get there and find some families facing foreclosure (an all too easy task).

I started out in the "8 Mile" neighborhood of Detroit. In the film 8 Mile, Eminem had portrayed the place as a lower-working-class dead end, the decayed monument to America's new era of downward mobility.

But now, it is much worse. When I found the home of Robert Pratt, the street had already been bank-bombed. Four or five houses had already been foreclosed and emptied, their windows smashed out, weeds belly high, doors hanging from one hinge, leaving the street like it had been busted in the face, with half its teeth missing.

That meant that the rest of the houses would go too. They were now, in this economic death zone, nearly worthless. Pratt's home, he told me, could maybe sell for $30,000.

Maybe. He owed the bank $110,000 on it.

It was a nice home, actually, a small, neat bungalow where his surviving four kids played, though not outside. (Pratt's twelve-year-old had died of a stray bullet while playing in their backyard.)

Pratt, a member of the United Auto Workers, worked seven days a week, but his pay sank and his wife lost her job with the city as Detroit's government rushed toward bankruptcy.

In the meantime, his monthly payments on the home doubled under some truly usurious interest formula used by Bank of America's Countrywide subprime mortgage unit. With two union jobs in the family when they applied, the Pratts should not have been given the brutally costly subprime rate, but the bank, according to the records, steered nearly every Black family into subprime. And now they couldn't pay the rising interest, doubling their monthly bill. So the bank's law firm, Trott & Trott, told them they had to get out of the house.

As the house was effectively worthless and no one would buy it even if the Pratts left to sleep in their car, what was the point of throwing the family out? The point was that Trott & Trott, a "mortgage mill," made a fee on each foreclosure and eviction. They did hundreds at a time.

I thought I'd check out the firm and headed off to their huge headquarters on the other side of town. It was slick, new, and several stories: business was booming. With my cameraman Rick Rowley, I was trying to figure how I could jump one of the Trotts themselves to find out about the foreclosures--and the voter-roll purges.

We pretended to film some executives, following them through the security doors, into the main lobby, and up to Mr. Trott's office. Did the Trott Brothers give their lists of properties they slated for foreclosure to the GOP?

Their answer was to call security. On the ground floor, as we stalled while getting hustled out, we saw to our left what looked like just another division of the Trott & Trott foreclosure factory. Except for a small sign that said, John McCain for President, Michigan State Headquarters.

Mystery solved. That was a quick investigation. Still, we slipped back in to ask if the Republican campaign was using Trott & Trott foreclosure lists to eliminate citizens' voting rights.

Their answer was expected. "You wouldn't want illegal voters to cast ballots, would you?" said a functionary. No, I wouldn't. I guess that poverty had become a crime in Michigan.

Today, Trott & Trott is legal counsel to the Mitt Romney for President campaign. The firm has tossed $100,000 into the Restore Our Future kitty for Mitty. And, so as not to create PR problems for the campaign, Trott & Trott won't foreclose on more than one thousand houses in Romney's hometown here in Michigan. (I made that up: foreclosures continue.)

I think of Romney's line, that "we Republicans are a party that celebrates success." When T&T boot a family of voters from a home, is the celebration of their success held upstairs in the partners' offices or on the ground floor at GOP headquarters?

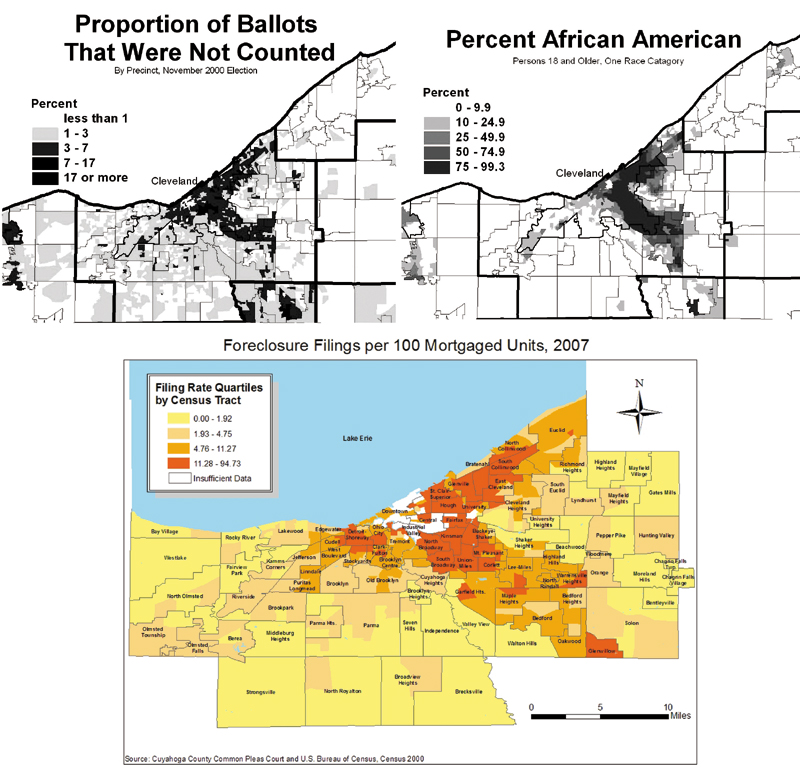

All over America, foreclosure and vote loss go hand in hand, fist in claw. Take a look at this comparison of precincts of high vote loss due to "spoilage" (votes cast, then disqualified) compared to high incidence of foreclosures in Cleveland, Ohio. It's not just a matter of "lose your home, then lose your votes." These neighborhoods are weakened financially and politically. It goes together.

And it matters. You are looking at a scattergram of the ballots spoiled and rejected that reelected George Bush in 2004. Compare it to the foreclosure diagram. God Bless America.

I ran the Pratt family's story and the evidence of the purge of the impoverished on European television. But I wasn't done with the story in Detroit, of homes and votes lost. Something bothered me. So many houses empty with that whoosh of running water--pipes stripped out before the city can turn the water off. Why so many?

The Republican windfall, "foreclosing" on voter registrations, that's just the endgame to make sure the victims of the con don't have the political power to seek revenge.

But revenge for what?

This year, in 2012, I returned to the investigation to find out, to follow the money.

The working class of Detroit was losing billions of dollars in wages and pensions. And one thing I know about a billion dollars--if someone loses it, someone else has found it.

And all I could think of was this: someone wants these houses to die. Someone wants Detroit to fall to its knees, wants Robert Pratt to stay awake at night hoping against hope to keep his bungalow in the warzone of 8 Mile.

Who would be so sick, so devious and cruel and brilliant, as to want the housing market in Michigan to die--the entire U.S. market to?

Here's who:

In August 2007, one year before I walked into Robert Pratt's home, John Paulson walked into Goldman Sachs, the investment bank, with a billion-dollar idea. Paulson's brainstorm had all the elements that Goldman found enchanting: a bit of fraud, a bit of flimflam, and lots and lots of the ultimate drug: OPM--Other Peoples' Money.

Paulson's scheme was simple. Paulson, a much followed hotshot hedge-fund manager, would announce that he was betting big on the recovery of the U.S. housing market. He was willing to personally insure that billions of shaky subprime mortgages, like the one dumped on the Pratts, would never go into default.

Now, all Goldman had to do was line up some suckers with more money than sense, some big European banks that handled public pension funds, and get them to put up several billion dollars to join with Paulson to insure these shaky mortgages. Paulson, to lure the "marks" into betting the billions, would pretend to put $200 million into the investment himself.

But, in fact, Paulson would be betting against those very mortgages. Paulson himself was the secret beneficiary of the "insurance" on the mortgages. When the housing market went bust, Paulson would collect from the duped banks and they'd never even know it.

And Goldman would get a $15 million fee, or more, for lining up the sheep for the fleecing.

Goldman provided Paulson with a twenty-nine-year-old kid, a French neophyte, to play the shill, making presentations to the European buyers with a fancy, twenty-eight-page "flip-book" about the wonderful, secure set of home mortgages the "clients" would be buying.

The carefully selected bag of sick mortgages was packaged up into bundles totaling several billion dollars. To paint this turd gold, Paulson and Goldman brought in the well-respected risk-management arm of ACA Capital. Paulson personally met with ACA and gave them jive that he himself was investing in the insurance (as opposed to investing against the insurance).

The young punk that Goldman put on the case texted a friend (in French--mais oui!--about the inscrutable "monstruosites") while he was in the meeting with Paulson and ACA, right while Paulson was laying on the bullshit.

Secretly, Paulson personally designed the package of mortgages to load it up heavily with losers, concentrating on adjustable rate mortgages, like Pratt's, given to those with low credit scores, while culling out high-quality loans given by West Coast banker Wells Fargo. ACA, thinking Paulson was helping them pick the good stuff, put their valuable seal of approval on the mortgage packages, though they were quite nervous about their "reputation." (But that's what happens when you go out with bad boys.)

The mortgages in each package were dripping dreck--but with the ACA/Goldman stamp, Moody's and Standard & Poors gave the insurance policies a AAA rating.

European banks that hold government pension investments snapped up the AAA-rated junk.

Around August 7, 2008, the week I met with Pratt, his foreclosure and over a million others resulted in the Goldman mortgage securities losing 99% of their value. The Royal Bank of Scotland, left holding the bag, wrote a check to Goldman Sachs for just short of one billion ($840,909,090). Goldman did the honorable thing . . . and turned over the money to Paulson (after taking their slice).

Don't worry about the Royal Bank of Scotland. The British taxpayers and Bank of England covered its loss, taking over the bleeding bank.

And here's the brilliance of it: when it came out that Goldman and other mortgage-backed securities were simply hot steaming piles of manure, their value plummeted further and the mortgage market, already wounded, now collapsed--and mortgage defaults accelerated nationwide. The result was that as the market plummeted, Paulson's profits skyrocketed: his hedge fund pulled in $3.5 billion and Paulson put over a billion of it in his own pocket.

With Paulson skinning some of Europe's leading banks for billions, there was a bit of a diplomatic and legal dustup. The SEC investigated, confirmed in detail Paulson's scam and sued the kid at Goldman who acted as Paulson's assistant, the one who couldn't even follow the complex deal. Goldman paid a fine, admitted no wrongdoing.

And Paulson received ... a tax break.

Pratt and several million others lost their homes, including a Saudi prince who, in the recession, had to sell his Vail, Colorado, home to Paulson for just $45 million.

Now Paulson and his fellow hedge sharks needed their own insurance policy: a few politicians who would protect the tax dodge and keep the SEC enforcement dogs on a tight leash. Paulson wasn't alone in profiteering from the savaging of the mortgage market and the collapse of GM. There was his billionaire buddy Paul Singer, know on Wall Street as "The Vulture." They teamed up first on a scheme to pocket two and a half billion dollars in U.S. Treasury TARP money--they got it--and second, to put together the super-PAC Restore Our Future. They each ante'd up a million.

To restore the billionaires' future, the super-PACs first order of business was to ally with Karl Rove who created a massive database on American, "DataTrust," which in turn, combined their efforts with a second massive database, "Themis," funded by the Koch Brothers.

Together, the two monster databases could, it seems tell them what every American had for breakfast, the name of their first dog--and, of course, if they were in foreclosure. As a young man, Rove began using his database magic for Richard Nixon's campaign. By 2004, he was using the data for his boss George Bush.

At BBC, we'd gotten our hands on the Rove operation's confidential emails and I put them in front of civil rights attorney, law professor Robert F. Kennedy, Jr. He looked over the documents and concluded that Rove and his operatives "should be in jail."

But that's another story, in another chapter.

For information, go to BallotBandits.org. Billionaires & Ballot Bandits will be available from Dollars & Sense for a tax-deductible donation.