How the Rich Got Richer

As more and more pass-through business income goes to the super-rich, the income share of the top 1% doubles.

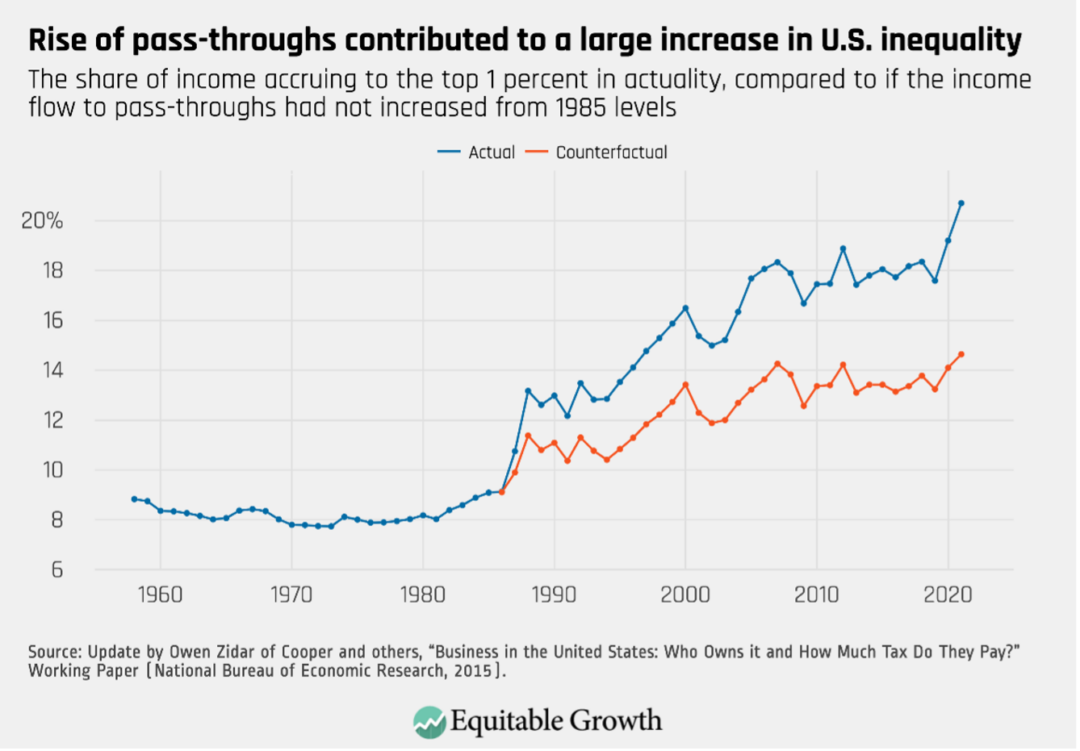

Massive inequality is the hallmark of today’s U.S. economy. Fully one-fifth of the nation’s income now goes to the richest 1% of families. That’s twice their income share from four decades ago. These horrifying trends are well-documented. The top (blue) line in Figure 1 depicts how the income share of the top 1% more than doubled from 9.09% in 1985 to 20.7% in 2021. That’s larger than the 19.6% income share of the top 1% in 1928 on the eve of the Great Depression.

This large increase in inequality is well-known. What is not well-known is the key role that pass-through business income played in this unrelenting rise in the share of our nation’s income that went to the super-rich.

Unless you’re a tax nerd, like yours truly, pass-through business income is probably not part of your everyday vocabulary. But pass-through income is a remarkably apt term for the tax treatment of the profits of businesses that don’t pay corporate income taxes. The profits of sole proprietorships (businesses with a single owner), partnerships (law firms, investment firms, and other businesses with multiple owners), and S-corporations (companies with 100 or fewer stockholders) are not subject to the corporate income tax. Rather, their profits are “passed through” their business to the owners, who then themselves pay individual income taxes on those profits (along with their other sources of income). The profits of C-corporations, on the other hand, are taxed at the corporate level (by the corporate income tax) and then by the individual income tax when their profits are remitted to stockholders in the form of dividends.

Pass-through businesses have accounted for a larger and larger share of business income since 1980. And since 2006, pass-through income has consistently accounted for more than 50% of business income. Pass-through businesses offer considerable tax advantages to their owners. In their detailed National Bureau of Economic Research (NBER) study of IRS tax returns, economist Michael Cooper and his co-authors established that the owners of pass-through businesses paid a lower tax rate on their business income than the tax rate on the profits of C-corporations. In 2011, the effective tax rate (taxes owed as a share of a business’s total income) was 13.6% for sole proprietorships, 15.9% for partnerships, and 25.0% for S-corporations. All those rates were substantially lower than the 31.6% effective tax rate levied on the business income of C-corporations. In addition, in 2011, much of the country’s pass-through business income went to the richest 1% of families. Overall, 69% of pass-through income went to the richest 1%. For instance, the average top 1% household received over 600 times the partnership income as the average household in the bottom half of the distribution of income

The increasing amount of pass-through business income going to the richest 1% helped fuel the decades-long increase in U.S. inequality. Economist Owen Zidar, one of the authors of the NBER study mentioned above, has calculated just how much pass-through business income has contributed to the dramatic increase in the income share of the top 1% from 1985 to 2021. In 1985, 1.00% of the total national income of the richest 1% came from pass-through business income, and 8.09% of the total came from other sources. By 2021, 7.06% of the total came from pass-through business income, and 14.64% of the total came from other sources.

Based on those figures, Zidar calculates what would have happened to the income share of the the richest 1% since 1985 if pass-through business income going to the richest 1% continued to account for 1.00% of the income of the nation and not a larger share. The answer is depicted by the lower (red) line in the figure above. In that case, the income share of the top 1% would have increased 5.55 percentage points from 1985 to 2021, not 11.61 percentage points. In other words, the ever-increasing share of pass-through business income going to the top 1% is responsible for over half (52.2%) of the increase in their share of national income from 1985 to 2021.

If we’re going to make our economy more equal, it is high time that corporations, pass-through business owners, and corporate shareholders pay their fair share of taxes. That begins by repealing the provisions of Trump’s 2017 tax cut that were made permanent in his 2025 One Big Beautiful Bill, which made things even worse. The 2017 tax cut allowed taxpayers to deduct 20% of their pass-through business income from their taxable income, in effect lowering their highest income tax bracket (or marginal tax rate) from 37% to 29%. Pass-through business income needs to be taxed at least at the same rate as workers’ wage income, not at lower rates. The same is true for dividends paid to stockholders. The 20% cap on the highest tax rate on dividends needs to be repealed, and dividends should be subject to the same 37% maximum income tax rate on wages and other income.

The problems with Trump’s tax bill aren’t just their treatment of pass-through business income. His tax bills gutted the corporate income tax, slashing the tax rate from 35% to just 21%. And the effective corporate income tax (corporate tax liability as a share of total profits) had fallen to just 12.6% in 2020, lower than at any time since 1952. (The earliest data available.) All told, Trump’s 2025 bill cuts an average of $68,430 from the taxes of the top 1%, all with an income of at least $916,9000, and an average $30 from the taxes paid by the poorest 20%. Worse yet, after the bill’s spending cuts, the poorest 40% of taxpayers will have less income after taxes and transfers, not more.