Fighting Climate Change in Portlandia

Not only is failure not an option, those fighting to avert cataclysmic climate change have achieved important successes worthy of celebrating.

Here are three views of the bill's horrific distributional consequences.

If you look past Republicans’ feigned concern about budget deficits, President Donald Trump’s Big Beautiful Bill, which was recently passed by Congress, is quintessential Republican legislation. It showers tax cuts on the wealthy at the same time that it slashes welfare state programs that better the lives of poor and working families. The distributional consequences of the bill make it clear that it is “one of the greatest acts of thievery in the history of the United States,” as Senator Bernie Sanders has described it. The charts below document the distributional criminality of this one big, ugly bill.

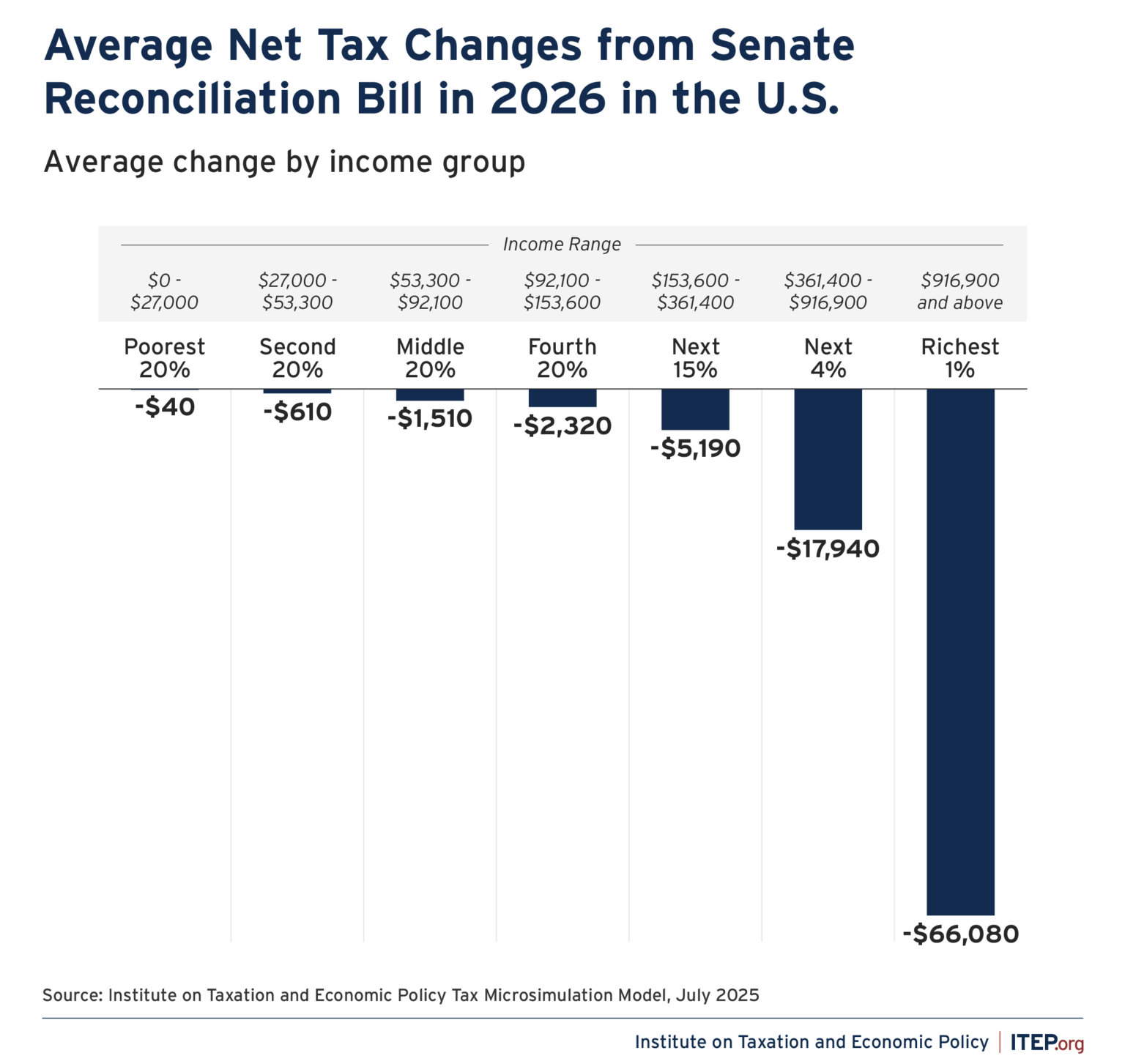

Figure 1 from the Institute on Taxation and Economic Policy (ITEP) makes it clear that the primary mission of the bill was to deliver a $4.5 trillion tax cut that overwhelmingly benefited the richest taxpayers. The bill made permanent Trump’s 2017 tax cut, which included lowering the top income tax rate, increasing the exemption for estate taxes, and slashing corporate taxes. The average tax cut next year will be $30 for the poorest 20% of taxpayers, $1,580 for the middle fifth, and $68,430 for the top 1%, with incomes of at least $916,900.

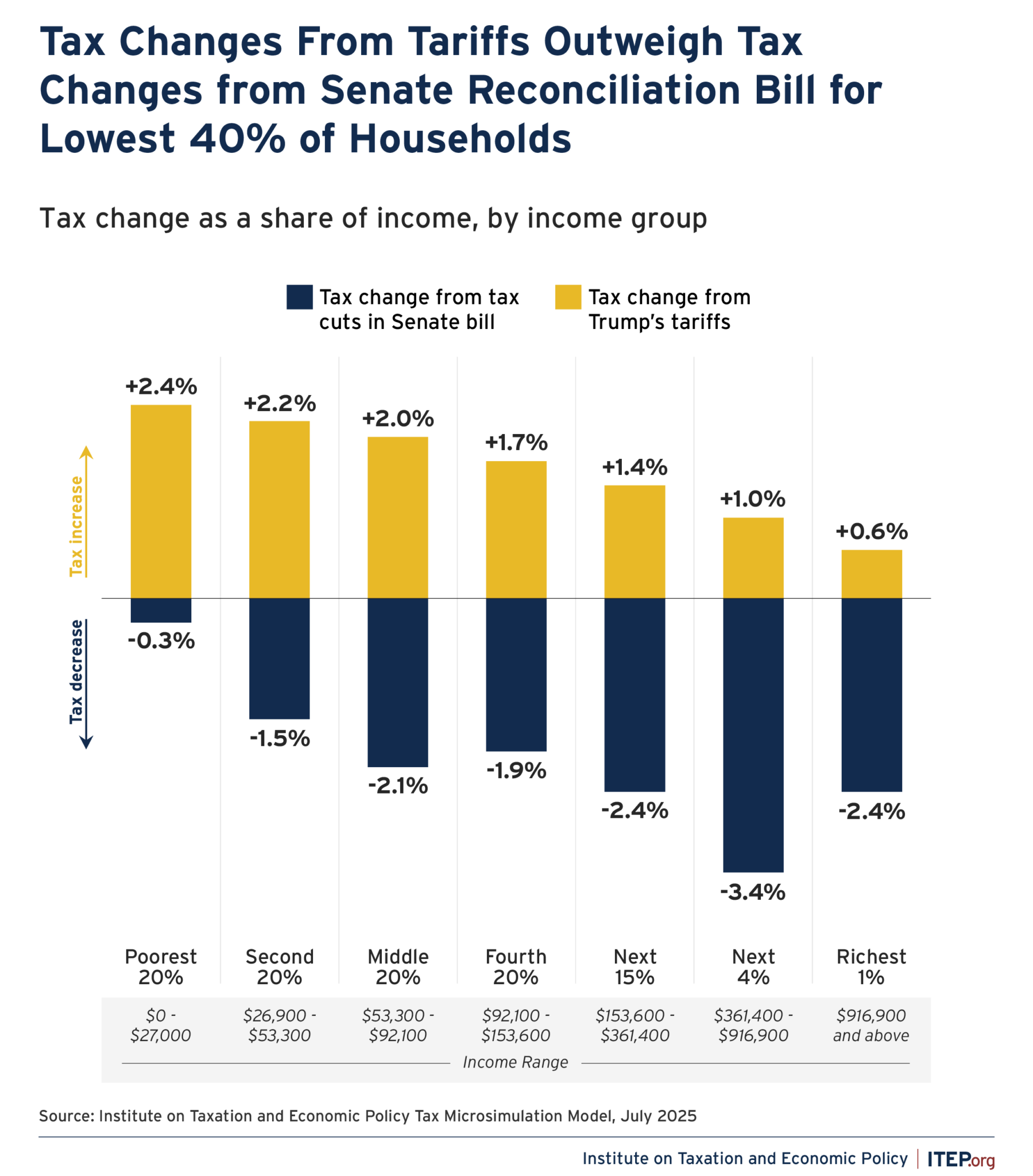

This big, ugly bill comes on top of Trump’s tariffs, which are pretty damn ugly as well. Tariffs are a sales tax on imports. They push up the prices faced by consumers. Their economic burden falls disproportionately on poor and middle-income taxpayers who consume a larger portion of their income than better-off taxpayers. Adding on the tax burden of higher tariffs will leave the poorest 40% with less income after taxes compared to when Trump’s second term began. And that’s without taking into account the additional reciprocal tariffs Trump promises to reimpose on July 9. Figure 2 below, also from ITEP, makes that clear.

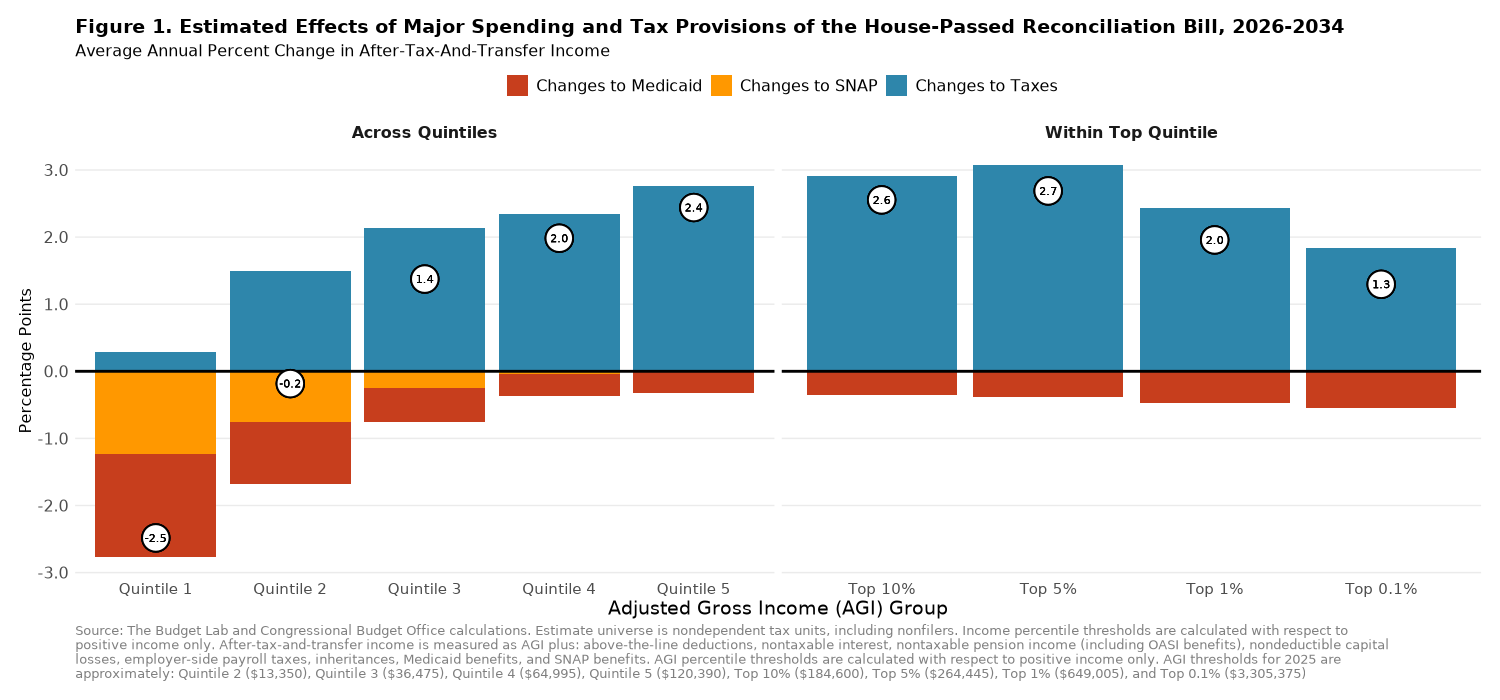

But nothing is uglier than the deep cuts in much-needed social programs that are imposed by the big, ugly bill. The figure below from the Yale Budget Lab depicts the distribution of changes in income after not only the bill’s tax cuts but also from it cutting $930 billion from Medicaid benefits over the next decade and snatching away $285 billion in SNAP (Supplemental Nutritional Assistance Program) benefits from the hungry. The poorest 20% of taxpayers, and the next 20% of taxpayers above them, will both have less income after taxes and government transfers over the next decade. The poorest 20% will be the hardest hit. They will have 2.9% less income after taxes and transfers. Cuts in Medicaid will reduce their income by 2.4%, cuts in SNAP benefits will lower their income by another 0.8%, and the tax cuts only add back 0.3% to their income.

In short, Trump’s Big Beautiful Bill is a monstrosity. It punishes the poor and near-poor to pay for massive tax cuts for the rich, if only partially. That is truly criminal.