Discredited, Discarded, and Demented: Donald Trump and His Tariffs

Instead of using the Supreme Court’s decision as an opportunity to liberate himself from his biggest policy blunder, Trump has doubled down on tariffs.

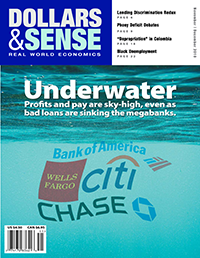

Profits and pay are sky-high, even as bad loans are sinking the megabanks.

Since the catastrophic bank collapses of 2008 and the government rescue of the finance industry, Wall Street has staged a dramatic comeback. Since the bailout, profits are up, capital reserves are up, stock prices are up, government direct aid has been paid back, and executive compensation is exploding. But a closer look shows bank stability is just skin-deep, and dense accounting rules hide a powder keg of bad debt and mounting funding issues. While the recent paper-thin re-regulation of finance was a major political victory, the banks’ core business is headed downhill and even worse trouble seems to lie ahead.

All of the big four U.S. megabanks—Bank of America, Citigroup, Chase, and Wells Fargo—reported either decreases or very modest increases in their massive profitability during 2010. But this surprisingly weak performance would have been even more disappointing without a pair of accounting maneuvers. One was a bookkeeping measure allowing banks to book projected profit from buying back their debt when their bonds become cheaper. But the banks rarely buy back their debt, so this is essentially a paper gain. The other penstroke that boosted profit was consumption of money set aside to protect against losses on loans—as banks have grown more outwardly confident about the economic recovery, they have lowered their stated expectations of bad loans and designated some of their capital cushions as profit.

But these shallow techniques for elevating profit weren’t enough to compensate for the decline in banks’ core business—interest income, the money collected from loans minus that paid out to depositors. That income has consistently dropped this year, mainly due to falling loan volume. Banks are making fewer loans to consumers and businesses, citing a “lack of demand,” which obscures the quite favorable credit rating now required to get a loan. The lower supply of qualified applicants as job losses persist, combined with locking out applicants with spottier credit history and a general consumer preference to reduce total debt, have all caused bank loan books to continue to shrink in the feeble recovery.

The market has not rewarded the banks for the elaborate camouflage of this core weakness, and their stock prices have lately sagged as a result. But executive compensation is another story, and traders’ pay is also rebounding into the $200,000-to-$500,000 range, while tens of millions of Americans struggle to keep food on the table. Meanwhile Obama’s much-hailed “pay czar” in charge of monitoring finance executive compensation, Kenneth Feinberg, has reported that within three months of receiving their bailouts, the megabanks had paid out $1.6 billion in bonuses—up to a quarter of their TARP rescue totals. However, the “czar” has no formal power to rescind exorbitant pay now that the majors have repaid their government capital infusions, and compensation will now be monitored by a rather unintimidating consortium of regulators. With the CEOs of the banking majors making about a million a year each in straight salary, no upward limit is in sight for financier compensation. But the banking institutions themselves may have some bumpy days ahead.

While the banking majors were relieved of much of their bad home mortgage-based investments by government purchases in the course of the financial crisis and aftermath, large loans related to commercial real estate remained on their books. Many of these loans were to growing businesses and overoptimistic developers, and have frequently failed to perform, as the recession has rendered projects unprofitable, reducing borrowers’ ability to repay.

But the loans are often for sobering amounts, upwards of tens of millions of dollars, and rather than foreclose on such large credit lines, banks large and small are engaging in what has come to be called “extend and pretend.” The practice involves not taking legal measures on underperforming commercial real-estate loans, but rather “restructuring” loans with new, more favorable terms for the borrowers, like below-market interest rates or extended timelines for repayment. The goal of the practice is to prevent foreclosure on large loans, with the hope that extending maturities will give borrowers enough time to recover their business and repay.

There are several problems with this practice. First, it conceals the real condition of the commercial real-estate market. Second, the restructured loans are usually still foreclosed upon in the end—in first quarter of fiscal year 2010, 44% of restructured loans were still a month or more delinquent, a fact related to the startling two-thirds of commercial real-estate loans maturing by 2014 that are underwater—meaning that the property is worth less than the bank loan itself. Finally, the bad loans take up space on bank balance sheets that could go to real lending. This suggests that the banks’ current predicament may lead to a miniature version of 1990s Japan, where refusal to accept real-estate loan losses led to a decade of slow growth, in part due to banks’ inability to make fresh loans when demand recovered.

However, the “extend and pretend” policy presents one major benefit to the big banks: restructuring these loans allows banks to count them as “performing” rather than delinquent or worse, which means banks may reduce their capital reserves against losses. This enables banks to claim their capital cushions as profit; banks remain in denial about their bad loans, and this itself allows the recent profit increases. And when banks are one day obliged to confront these serious losses, they may find they no longer have the capital cushion to absorb the damage.

This ominous hidden liability is on top of the better-publicized problem of banks’ under-performing residential mortgage holdings. The mortgage delinquency rate is now hovering around 10% nationwide, and including those behind on payments and those on the verge of eviction, fully one U.S. mortgage in seven is in some kind of trouble. Importantly, the bad mortgage debt on banks’ books has ceased to be a primarily “subprime” phenomenon of low-income loan recipients; over a third of new foreclosures early this year were prime fixed-rate loans, as the layoff-intensive recovery pulls the rug out from under mortgage recipients.

Notably, the home mortgages still held by the banks are listed on bank balance sheets at inflated values since they are for homes bought at the housing bubble peak, and government has not forced the banks to account them at any reasonable value. And beside this additional hidden weakness and the space taken up on bank balance sheets by this bad mortgage debt, the banking majors are vulnerable to moves by insurers and other investors to force the banks to repurchase securitized home loans sold to them at wildly inflated prices. So far, losses on affected and expected repurchases have cost the biggest four U.S. banks nearly $10 billion, with further losses anticipated.

Meanwhile, the banks have allowed extremely few mortgage borrowers to modify their mortgages or reduce their principal—the National Bureau of Economic Research has found that just 8% of delinquent borrowers received any modification, while a pitiful 3% have received reductions in their total owed principal. However, about half of all seriously delinquent borrowers have had foreclosure proceedings brought by their bank. Of course, banks ultimately benefit more from a renegotiated loan that is paid off than from a foreclosure, but the long timeline required in the foreclosure process allows the banks to once again push back acknowledgement of the loss.

The banks’ rush to foreclose is reflected in the recent suspension of the practice by several megabanks, after discovery that foreclosure standards were not being followed, with single employees overseeing upwards of 400 foreclosures daily, far more than can be properly reviewed according to legal standards. The investigation by state attorneys general adds to the legal swamp that may slow down the flood of foreclosures, but also testifies to the large banks’ preference for foreclosure over loan modification.

Banks face other market difficulties in the near future. One involves the increased reliance of the large banks on short-term borrowing to fund their loan portfolios. While banks have issued bonds to raise loan capital for years, in recent years they have grown increasingly dependent on short-term borrowing—the average maturity of recent bank bond issues is under five years, the shortest in decades. This is in fact why the seizing up of the credit markets in 2008 was such a big deal—banks were in immediate trouble if they couldn’t borrow. Of course, the government bailout included guarantees for short-term bonds, leading the banks to become even more reliant upon them.

This means banks must “turn over” their debt more frequently—they must issue fresh bonds to raise capital to pay off the maturing older bonds—and U.S. banks must refinance over a trillion dollars through 2010. The problem is that banks will be competing with huge bond rollovers from state and federal government, which are heavily indebted because of upper-class tax cuts, as well as expensive wars and recent rounds of stimulus at the federal level. Even the powerful megabanks may struggle in this environment—as the New York Times puts it, “The cost of borrowing is likely to rise faster than banks can pass it on to customers.” The total demand for institutional credit may significantly spike in coming years, meaning perhaps higher interest rates as states and finance houses compete for the bond market’s favor, or a further decline in lending by banks due to prohibitive funding costs.

Meanwhile, smaller banks have experienced a different post-crisis environment. Despite some TARP bailout crumbs, they have gone under in record numbers—140 failed in 2009, with 2010 on track for a yet larger figure. Most of these smaller fry succumb to losses or suffocate under bad loans following the real-estate bubble of the last decade. This sector of the industry is ironically on track to cause more taxpayer losses from non-repayment of bailout funds than the majors, which have attracted the most scorn for taking TARP funds.

Compounding these stabilized but still shaky banking positions, the industry is now subject to a significantly reshaped regulatory environment. In addition to the major finance reform bill enacted in July, banks face new international capital standards in the Basel Rules and new regulatory scope for the Federal Reserve as well. But all these reforms have been limited by massive lobbying spending by Wall Street, coming to over $700 million in the last 18 months alone, as estimated by the Center For Responsive Politics. (See sidebars.)

A crucial part of the picture is the uncertainty caused by the notorious secrecy of the financial world. Large parts of the modern finance system do not accept deposits as commercial banks do, and therefore face far less regulation, allowing them to disclose much less information about their investments and leverage. Additionally, even the commercial banks are not obliged to report changes to the terms of their commercial real-estate holdings, obscuring the full extent of “extend-and-pretend” practices. And the Federal Reserve, for its part, has fought to preserve its own institutional secrecy. The Wall Street reform bill does include provisions for limited audits of the Fed’s open-market operations and discount window, the basic monetary policy tools used to manipulate interest rates and to modulate economic activity. But this casts little light on the Fed’s expansive holdings in mortgage securities and other paper bought from the banks in the course of the 2008-9 bailout. From the banks to the regulators, secrecy—and thus uncertainty—colors the picture.

In the end, moderately higher capital requirements and the public listing and indexing of derivatives may take the financial system back to short-term stability, but banks remain stuck with significant bad loans limiting core interest income, and continue to rely on market bubbles and on their outsized political power. They also face a difficult short-term bond market in the near future in addition to some higher regulatory costs, and crucially, their core business is further limited by weak credit demand in the low-expectations recovery. Unsurprisingly, compensation has rocketed back into seven figures in spite of these circumstances.

So while ordinary Americans limp along in a jobless recovery, the banks have their execs instead of Hell to pay.