Fighting Climate Change in Portlandia

Not only is failure not an option, those fighting to avert cataclysmic climate change have achieved important successes worthy of celebrating.

Our July/August 2018 issue is now at the printers, and the electronic version has been sent to e-subscribers. (Not a subscriber? You can subscribe here!)

Here is the editors' note from p. 2, with a guide to what's in the magazine:

This June, the U.S. Supreme Court issued a five–four ruling in Janus v. AFSCME that stops public-sector unions from collecting fair-share fees from non-members. The decision is a major victory for big business interests in their long-standing campaign to undermine union power. The ruling was no surprise. (D&S readers were prepared for the ruling by Gerald Friedman’s Economy in Numbers in our May/June issue on “Why Janus Matters.”) A similar case would have produced the same result two years ago if not for Justice Antonin Scalia’s timely demise. A few commentators hoped that the Court’s renowned “swing vote,” Anthony Kennedy, would side with the unions this time, but most expected what actually happened: Kennedy voted with the conservatives, as he did almost unfailingly in cases concerning workers’ rights and corporate power.

On the day of the Janus decision, Kennedy announced he was retiring from the Supreme Court. As our issue goes to print, it looks likely that Brett Kavanaugh will be confirmed as his replacement. Kavanaugh is a product of the Federalist Society, the right-wing legal association that has seen huge success in pushing the Republican agenda through judicial appointments on courts across the United States. Advocates for reproductive freedom rightfully fear that Kavanaugh will spell the end of the legal right to abortion—as attenuated as that right has already become in many states.

On many issues, Kavanaugh will be a more consistent conservative vote than Kennedy was. But when it comes to backing capitalist class power, Kavanaugh will be almost indistinguishable from Kennedy. Business interests have had a reliable friend in the judicial system in recent years, on issues ranging from private arbitration hearings to class action suits to protections for whistleblowers. These victories have taken place on courts both high and low. Indeed, Trump has appointed dozens of Federalist Society-approved judges in seats that remained vacant under President Obama due to Senate Republican obstructionism. But many of these victories came at the hands of both conservative and liberal judges. Now, as for most of U.S. history, the courts are a vexing obstacle to any challenge to corporate dominance.

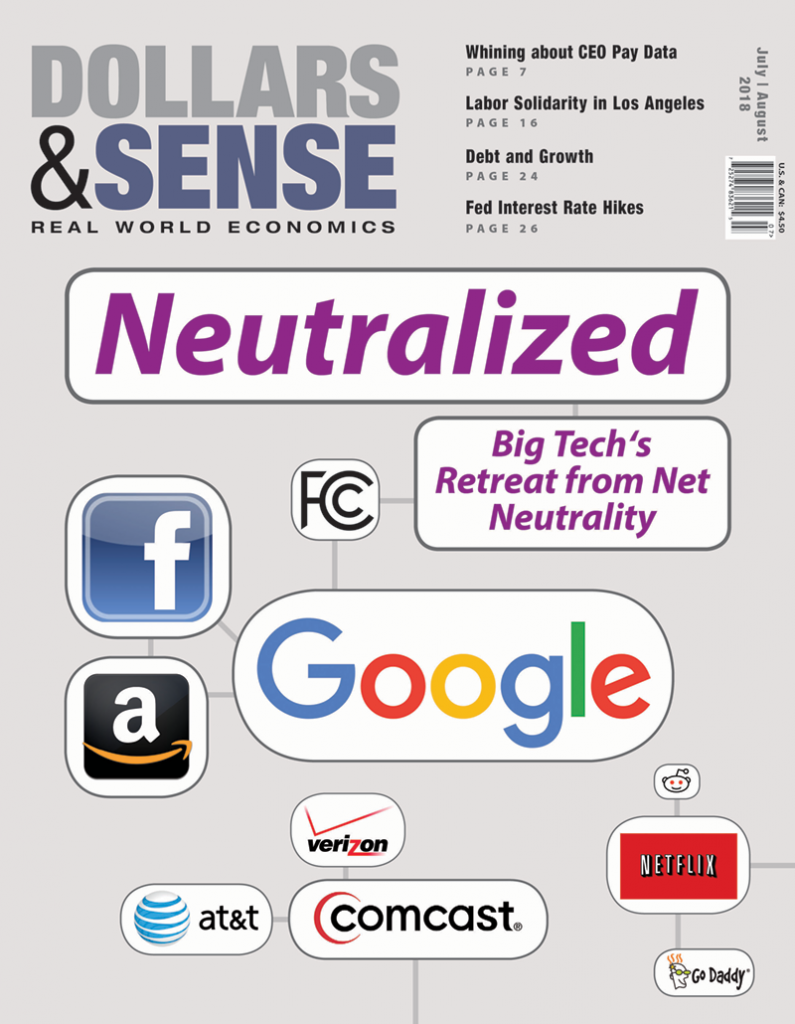

In our cover feature for this issue, Rob Larson looks at a case where some major corporations had positioned themselves on the side of progressive change: the battle over net neutrality. Tech companies fought alongside First Amendment activists and consumer advocates to retain net neutrality under Obama, but when Trump’s Federal Communications Commission moved to end net neutrality last year, the biggest companies had abandoned the cause. What happened? The answer, in short, is that the tech companies are transforming into the telecommunication companies they once opposed. This story reminds us, as Larson puts it, that “Capitalists are only social-change allies as long as it suits the bottom line.”

John Miller’s column in this issue examines another measure of corporate power: the ratio of pay for a CEO to an average worker at their company. New SEC data reveals how drastic the CEO pay gap really is, whatever corporate allies in the media might claim. Yet as Gerald Friedman explains in his column, the country’s wealthiest people haven’t been investing all that money back into the economy. The best explanation for rising public debt across the Global North in recent decades has been government spending to maintain growth in the face of declining private investment. Though this growth has slowed, especially since the Great Recession, Arthur MacEwan notes in his column that the Federal Reserve has started to raise interest rates in order to slow it even further. The Great Recession also contributed significantly to both public and private debt, as Steve Keen emphasizes in his recent book Can We Avoid Another Financial Crisis?, reviewed in this issue by Steven Pressman. Raising interest rates will only make another financial crisis more likely.

There are alternatives to an economy at the mercy of corporations. In the second installment of her series on developing an equitable economy in Los Angeles, Jane Paul shows us that another world is possible, and that the seeds of it are visible in our own. Cooperatives and other organizational models that shift power to workers can begin the slow work of economic transformation. As Costas Panayotakis writes in his review of Catherine Mulder’s important new book on co-ops and capitalism, these efforts will face challenges both external and internal. But they remind us that working people, so often on the defensive, can build their own power when bound together in creative solidarity.