(1) Recession Ended in June '09, Declares NBER: The Business Cycle Dating Committee of the National Bureau of Economic Research declared yesterday that the Great Recession (not the term they used) had ended in June of 2009. From the press release:

In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity. Rather, the committee determined only that the recession ended and a recovery began in that month. A recession is a period of falling economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. The trough marks the end of the declining phase and the start of the rising phase of the business cycle. Economic activity is typically below normal in the early stages of an expansion, and it sometimes remains so well into the expansion.

The committee decided that any future downturn of the economy would be a new recession and not a continuation of the recession that began in December 2007. The basis for this decision was the length and strength of the recovery to date.

Later in the press release there's an explanation of why they chose June '09 as the trough date even though some labor-market-related indicators had later troughs (e.g. Aggregate hours of work in the total economy (trough in October 09); Payroll survey employment (trough in December); Household survey employment (trough in December). The justification seems to be that some in other recent recessions unemployment continued to get worse even after other indicators (e.g. GDP) had bottomed out.

They also wanted to make a ruling on whether a further downturn (starting earlier this summer, maybe?) would count as a double-dip (i.e. part of the same recession) or a new recession.

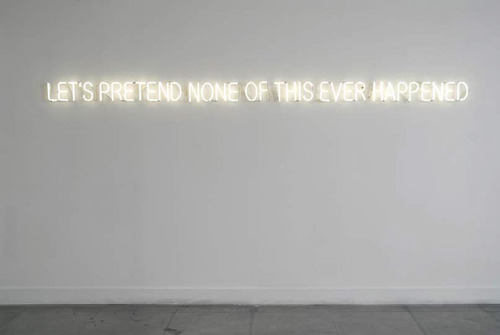

All I can say is: whew! Now we can stop worrying about that double-dip!

(2) Thank God for Bailouts, Not Handouts! Charles Munger, vice chair of Berkshire Hathaway, tells people hurting from the recession (whoops! I forgot it's over...) to stop "bitching" and "suck it in," and be grateful that Wall Street got bailed out, according to an article in Bloomberg BusinessWeek. The juicy bits:

“You should thank God” for bank bailouts, Munger said in a discussion at the University of Michigan on Sept. 14, according to a video posted on the Internet. “Now, if you talk about bailouts for everybody else, there comes a place where if you just start bailing out all the individuals instead of telling them to adapt, the culture dies.”

...

“Hit the economy with enough misery and enough disruption, destroy the currency, and God knows what happens,” Munger said. “So I think when you have troubles like that you shouldn’t be bitching about a little bailout. You should have been thinking it should have been bigger.”

...

Taxpayer funds injected into banks helped insulate bond investors from losses and cushioned stock declines for equity holders. U.S. programs designed to ease the burden for distressed mortgage holders didn’t prevent foreclosures from rising to a record. One out of every 381 households received a foreclosure filing in August, according to RealtyTrac Inc.

“Charlie Munger is misrepresenting history, and that’s why the public is angry at Wall Street,” said Joshua Rosner, an analyst at research firm Graham Fisher & Co. “We could have wiped out the equity holders before we wiped out the taxpayer.”

...

At the Michigan event, one questioner said he had attended both Berkshire and Wesco meetings. “You mean the groupies have followed me here?” Munger asked. To another who asked whether the government should have bailed out homeowners instead of Wall Street, Munger said: “You’ve got it exactly wrong.”

“There’s danger in just shoveling out money to people who say, ‘My life is a little harder than it used to be,’” Munger said at the event, which was moderated by CNBC’s Becky Quick. “At a certain place you’ve got to say to the people, ‘Suck it in and cope, buddy. Suck it in and cope.’”

Read the whole article. I guess if the bankers are doing "God's work," then we should all thank God that the gov't bailed them out instead of helping people facing foreclosure or unemployment.

In any case, we can forget about it all, since the recession is long over.

--Chris Sturr