(1) New Economy Week: It's New Economy Week! Sponsored by the New Economics Institute. I have just two related items to mention:

- Our November/December issue will feature an article by Abby Scher on alternative finance, with a focus on alternative financing for co-ops. (Abby wrote our July/August 2012 cover story, Greetings from the New Economy, whose cover image I've noticed has gotten adopted by NEI and other organizations as an illustration of the New Economy.

- Today there is an event in the Boston area that is part of New Economy Week: Building New Economies From the Ground Up:Visions from Boston and Mondragon, up at Tufts, featuring Aaron Tanaka and Juan Leyton, both Visiting Practitioners with the Tufts Urban & Environmental Policy and Planning Department (and Aaron is a former student and thesis supervisee of mine).

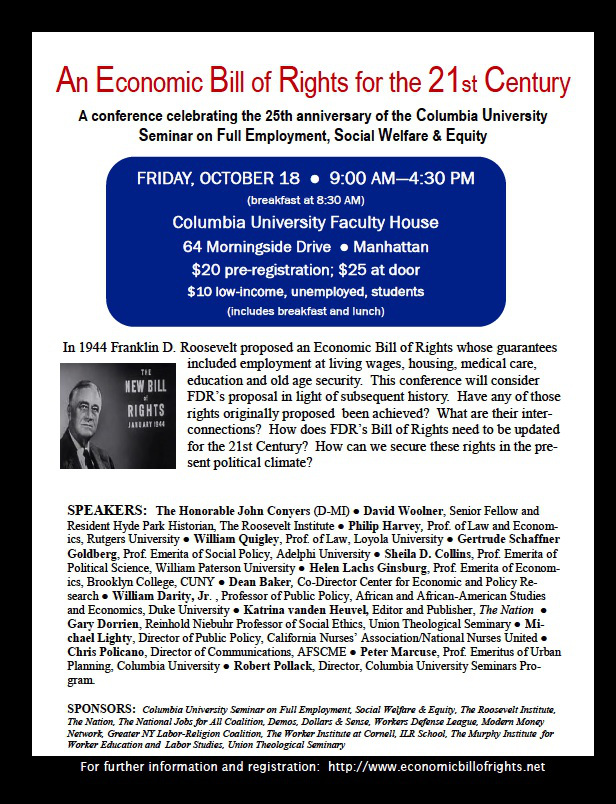

(2) An Economic Bill of Rights for the 21st Century--A Conference: This Friday (the 18th) there will be a conference celebrating the 25th anniversary of the Columbia U. Seminar on Full Employment, Social Welfare, & Equity, co-sponsored by a bunch of great organizations, including D&S. See the flyer at the top of this post for more info. Get the pre-registration discount ($20 instead of $25) if you register in advance. More details here.

(3) The So-Called "Nobel" Prize: When Ratzinger became pope, I decided that I was going to stop going along with the whole re-naming charade--I never shifted from Ratzinger to Benedict. (Ok, it was easy with him--I am finding it harder to keep with Bergoglio vs. Francis, partly because Bergoglio is hard to remember, and partly because Francis is turning out to be surprisingly cool, at least in comparison with the popes since John XXIII.) I am thinking we should similarly refuse to call the economics Nobel "Nobel," given that it isn't really a Nobel--given instead by the Swedish central bank, and only since 1968. So let's call it the Sveriges Riksbank "Nobel" Prize. Here are some items related to the 2013 award to Eugene Fama, Lars Peter Hansen, and Robert Shiller:

- Yanis Yaroufakis posted this to his blog, under the title Economics ‘Nobel’ 2013: An instinctive reaction: "The moment I heard that Fama and Shiller (together with Hansen) were awarded the latest pseudo-Nobel in Economics, my initial thought was: What next? A Darwin Prize to some Arch Creationist? The Award for Top Seamanship to the Titanic’s captain? But then I quickly changed my mind. Awarding this ‘Nobel’ to both Fama and Shiller was a brilliant hedge. One that can only be bested by awarding the Physics Nobel to Galileo and to the Inquisitor who condemned him." There's a follow-up post from Yaroufakis, Professor Fama's "Nobel" Prize Toxic Theory Explained, explaining the Efficient Market Hypothesis, an excerpt from his book The Global Minotaur.

- Business Insider has a useful piece, Nobel Prize Winner Robert Shiller Is Responsible For The 2 Most Important Charts Of The Last Two Decades. They use the Swedish bank name, and I like how their headline just ignores Fama and Hansen.

I'll have more stuff to post on the SR"N" Prize soon.

(4) More on Shutdown and Debt Limit: Two notable items:

- David Sirota: The Right's Hidden Victory: The Ideologues Win, even if GOP Loses!

- Could the Fed Forgive Debt? Hat-tip to Ron Baiman of the Chicago Political Economy Group on the possibility that the Fed could just cancel $2.1 trillion in debt:

I just heard about this on Thom Hartmann's program (thanks Thom!).This is apparently Rep.Ron Paul's idea that has been taken up and supported by Rep. Alan Grayson (so how bad can it be!).As the Fed routinely does not collect interest on Treasury Bills that it "buys" from the Gov. with money that it creates out of thin air, there is really no reason to keep this "debt" on the books at all. Cancelling the $ 2.1 Trillion of U.S. Gov. Debt held by the Fed could keep us below the self imposed and utterly artificial "debt limit" crisis, at least for a while. Apparently the Fed has the authority to do this. The Fed does not need to cancel all of its $2.1 Trillion. It could retain a sufficient stock of T-Bills to engage in normal open market operations.See: http://www.marketoracle.co.uk/Article42663.html for some reporting on this.[There's also a piece about this on one of the Financial Times blogs: Will Central Banks Cancel Government Debt? But you have to register for the FT to read it. It's not hard to do so, though.}

- Mumia Abu Jamal:

This strategy shreds any remnants of trust in the competence and ability of government, and sells the ludicrous notion that the private sector is the solution to societal problems.

These forces have prevailed in some parts of Europe, forcing governments to shed social services to the poor, the unemployed and the young. Those governments have created crises, but they have hardly solved them. Indeed, they have exacerbated them.

Such societies aren’t merely unequal; they have stoked social and class conflict.

Several decades ago, American economists (from the Chicago School of Economics) preached austerity throughout Latin America. Their economic recipes brought chaos, disaster and mass pain.

Naomi Klein has written movingly about such experiments, which ripped nations apart, in her 2007 work, The Shock Doctrine.

Now, it is here – disguised – but here. Schools are closing; repressive institutions are multiplying, and jobs are paying less and less.

Meanwhile, the 1% (remember Occupy?), the richest percentile of Americans, have made more money recently than at any previous period in the nation’s history.

This isn’t just a conservative program; it is also a neo-liberal program that prays at the holy altar of Wall Street.

The neo-liberal program of surrender to market forces has strengthened and energized rightist tendencies, and made the market the very center of national life: not the People.

So, schools close one day; governments shut their doors the next.

The Market prevails.

---© ’13 maj

That's it for today.

--Chris Sturr