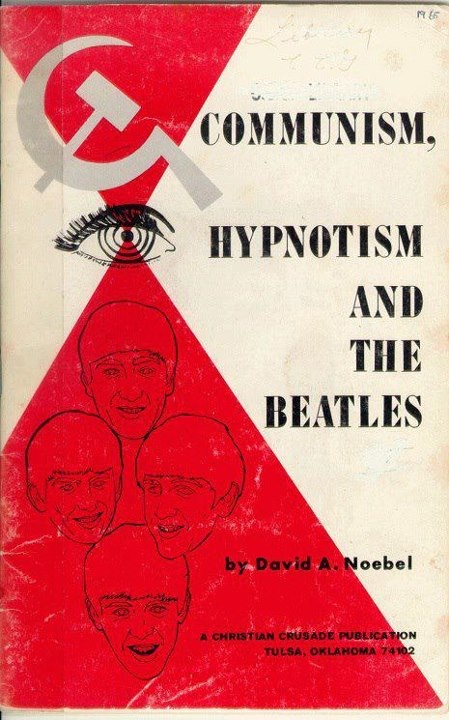

[Hat-tip to Byron S. for today's image; he said it was posted to Facebook by St. Marks Bookstore.]

(1) Blinder Leading the Blind: Great by Dan Kervick at New Economic Perspectives, Blinder Leading the Blind, taking Alan Blinder to task for buying into deficit hysteria in his piece on health-care costs in The Atlantic. A really nice analogy does much of the work in Kervick's piece:

It is possible that our pseudo-responsible councilman might also recommend selling the dam to a private sector firm, letting that firm provide the city with its electricity, water and flood prevention services, while also carrying out any needed maintenance. But here again we should note that you also don't fix the crumbling dam problem simply by selling the dam to a private utility company which will then take on responsibility for those burdens, and tack the dam maintenance costs onto everybody's water and electricity bill. The people of the city will pay either way. Maybe it makes sense to sell the dam; maybe it doesn't. But there is no argument to be made for privatizing the dam based just on pointing out that the cost of maintaining the dam will shift from the public's tax bills, payable to the city, to their water bills payable to a private company.

Kervick's bio says he does "analytic metaphysics," which makes me think he's an analytic philosopher. Nice to see an analytic philosopher putting his skills to such good use--the mainstream economists need the help! Sad that Blinder is playing the role of the pseudo-responsible councilman in this case.

(2) Austerity, US-Style, Exposed: Another great piece by Rick Wolff, at Truth-out. Like Kerwick, Wolff is calling U.S. deficit-hawk policies what they are: austerity. Here's the part I liked especially:

For Keynesians, austerity is thus unneeded and counterproductive. They prefer to exit the crisis by more stimulus (lower taxes and higher government spending) funded by higher deficits. The resulting economic growth, they believe, will automatically lower government budgetary imbalance. The government can then later, if and when needed, impose tax increases and reduce government spending to shrink deficits. In a growing economy, austerity policies avoid the devastating effects they have in depressed economies (as shown by the recent histories of Greece, Portugal, the UK and others).

Setting aside the question of the validity of Keynesian arguments, they miss key purposes of austerity policies. Those policies do not primarily seek to overcome crisis or resume economic growth. Rather, as argued above, they aim chiefly to (1) shift the burden of paying for crisis and bailouts onto the total population, (2) reduce the economic footprint of the government, and (3) reduce creditors' concerns about rising US debt levels. If austerity policies achieve these objectives, their failure to end the crisis quickly is a price that corporations and the rich are more than happy to pay (or rather, have others pay).

Read the whole piece. We will have a comment in our March/April issue by Rick about Steve Resnick, his longtime collaborator/co-author, who died earlier this year.

(3) Speaking of Keynesians: Paul Krugman's column today, Raise that Wage, argues that Obama's proposal to raise the minimum wage to $9/hour is "perhaps surprisingly" "a clear yes":

Why “surprisingly”? Well, Economics 101 tells us to be very cautious about attempts to legislate market outcomes. Every textbook--mine included--lays out the unintended consequences that flow from policies like rent controls or agricultural price supports.

I love how liberals like to throw radicals under the bus as part of their arguments for liberal conclusions. He is surely right that this is what Econ 101 teaches--so much for Econ 101. And Krugman misses an opportunity to call for a much higher minimum wage, as economist Jeannette Wicks-Lim does in our current lead article, which has been picked up by Alternet and other aggregators.

(4) Subway Economics: Hat-tip to Rick Wolff for this great video revealing who really "gets a raise" when he MTA raises fares in NYC (as they will do for the fourth time in five years next month). Great and quick explanation of interest-rate swaps around 2:18. (For a more detailed account of interest-rate swaps, see The Swap Crisis, by Darwin BondGraham, from our May/June 2012 issue. Darwin is working on an article for us about hedge funds and other big-money investors and the current U.S. housing market.) Here's that video:

Nice view of Zuccotti Park in the background at one point in the video.

That's all for now from snowy Syracuse (back in Boston on Wednesday).

--Chris Sturr