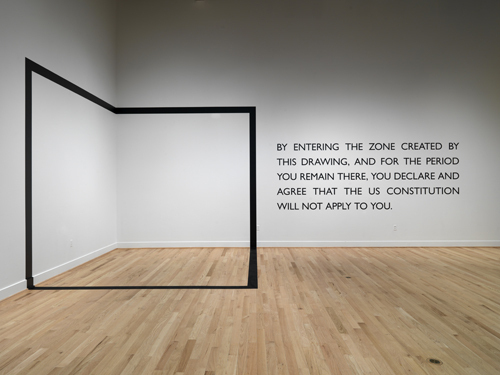

(Click on the image above--it is from a very interesting exhibit from 2005.)

(1) Europe Slumming It: Last month the LA Times and other outlets reported about IKEA's factory in Virginia where the company is treating workers in ways that would be unacceptable, and illegal, in Sweden. Workers are pushing back, garnering not much attention here, but apparently it is front-page news in Sweden, tarnishing IKEA's reputation there.

Now an op-ed by Harold Myerson in the LA Times connects the phenomenon of European companies coming to the United States for our low wages and lax labor regulations with European banks' shoddy practices around foreclosure. The U.S.: Where Europe Comes to Slum has a picture of a dilapidated house in LA owned by Deutsche Bank, which the city of Los Angeles is suing for being a slumlord:

Deutsche Bank

A yearlong city investigation of the properties on which Deutsche Bank foreclosed turned up tenants compelled to live in crumbling apartments the bank would not fix, houses taken over by gangs, faucets from which water either wouldn't flow or wouldn't stop, and the occasional unidentified dead body. Nothing, in other words, that would be allowed to happen to bank holdings in Frankfurt, the neat-as-a-pin German city that is home to Deutsche Bank and much of the rest of German finance.

The picture reminded me of the ones we ran with an article about the foreclosure crisis and renters a couple of years back--before-and-after pics of a house in New Haven, owned by ... Deutsche Bank.

(2) Foreclosure rulings: Speaking of foreclosures and banks, two recent rulings might make life harder for banks to push foreclosures through. One ruling in Oregon challenged the Mortgage Electronic Registration Systems (MERS), which "was created by the mortgage industry in the 1990s to facilitate the recording of mortgages that were being bundled and resold as securities," according to the Wall Street Journal, and may force banks to go through the courts to carry out foreclosures.

And the Supreme Judicial Court of Maine overturned a foreclosure, calling the paperwork "untrustworthy." The Wall Street Journal blog post about the case said, puzzlingly: "The issues raised in the case are separate from the robo-signing scandal that first erupted last fall, where bank employees were accused of signing paperwork without reviewing their contents." We reported about hat scandal, which originated in Maine, here. It seems quite related to the robo-signing cases, which were about robo-signing, but also about fraud via the creation of documents ex post facto. In the more recent case, again according to the Wall Street Journal blog post, the homeowners "challenged irregularities in the foreclosure documents that suggested potential fabrications or other shortcuts," including this egregious irregularity: "the initial affidavit in the case was dated and notarized on Sept. 10, 2008, even though it included the balance and late fees as of Jan. 29, 2009—or for four months that hadn’t yet happened." Sounds a lot like the robo-signing cases. What's more, the hero of the original Maine case, retired lawyer Thomas Cox, is serving as one of the lawyers for the homeowners in this case.

All this could slow down the foreclosure engines and further complicate the housing "recovery" (sorry--I find it hard to buy into the idea that increasing housing prices should be regarded as a good thing).

(3) Bill Black on Cost-Benefit Analysis and Regulation: An amusing blog post here.

(4) Judge Rules Against Wisconsin Anti-Union Law: The Dane County Circuit Court ruled that the Wisconsin State Senate's March 9th vote (the one they took without the Democratic Senators present, because they'd fled to Chicago) violated an "open meetings" law. Read about it in this article from the New York Times. But the case will go to the Wisconsin Supreme Court on June 6.

(4) The Cost of the Wars: The National Priorities Project has updated its page calculating the total cost of the wars since 2001. I'm not sure whether it includes the cost of the Libyan intervention, which according to an article by a Cato guy sent to me by my Ron-Paul-libertarian brother-in-law, is already up to $750 million.

(5) News from Syracuse: Two items from my hometown: First, an article by tax expert and former NYT reporter David Cay Johnston in the Syracuse New Times: Death and Taxes. Nice piece; hat-tip to T.M.

Plus I had noticed the toxic piece by the sadly unhinged Christopher Hitchens railing against Noam Chomsky over at Slate, calling him "stupid and ignorant" in the subtitle of the article (the title was "Chomsky's Follies"). All Chomsky said was that the killing of Osama bin Laden counted as state assassination and seems to have been illegal. Anyway, hat-tip to K.J.S. for letting me know that Chomsky responded to Hitchens at the 75th anniversary celebration of the Syracuse Peace Council, held at my alma mater, Nottingham High School. Watch the YouTube video:

--Chris Sturr