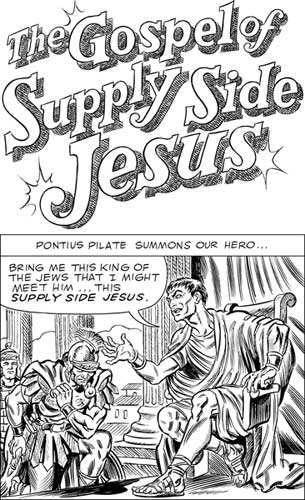

(1) The Gospel of Supply Side Jesus: Hat-tip to our cartoonist Barry Deutsch for sending me a link to The Gospel of Supply Side Jesus, by Don Simpson and Al Franken. It’s hilarious!

(2) Mitt’s Tax Havens: While we’re all waiting (probably in vain) for Mitt Romney to release more tax returns, Vanity Fair‘s August issue ran an investigative feature on Mitt Romney’s tax havens; and then Gawker put up The Bain Files: Inside Mitt Romney’s Tax-Dodging Cayman Schemes, which includes lots of original documents about Bain’s various investment entities and some analysis of their legality.

It’s a bit hard to sort out whether there’s a smoking gun here, but it looks like what we have are mostly legal tax dodges, plus some that may be illegal but that the IRS hasn’t ruled as such. There’s a ton of analysis out there, but an early post on it at Naked Capitalism is particularly useful, plus I liked a post at Business Insider. What seems possibly illegal is a maneuver that allows private equity firms to count management fees as capital gains rather than regular income (so they can be taxed at a much lower rate).

I also liked Naked Capitalism’s takedown of Bain’s press release defending itself after the documents were released. Bain said:

The unauthorized disclosure of a number of confidential fund financial statements is unfortunate. Our fund financials are routinely prepared by auditors and demonstrate a commitment to transparency with our investors and regulators, and compliance with all laws.

But as the NC poster Nanea, “a private equity insider,” points out, auditors actually don’t prepare financial statements for firms like Bain; “Instead, for liability reasons, they explicitly confine their activity to auditing the statements prepared by their clients and expressing an opinion about them based on the audit.” Also, “Bain’s statement talks about the documents evincing ‘… a commitment to transparency with our investors and regulators’. With respect to the regulators, none of these documents were ever filed with regulators.” This is because Bain sells unregistered securities, and only registered securities need to be filed with the SEC. Nanea concludes: “Ultimately, there doesn’t appear to be much about the Bain statement that is accurate.” NC’s Yves Smith contacted Bain about this, and the Bain spokesperson told her that ““these funds are SEC registered funds.” Yet Bain’s filings with the SEC say that Bain

exempt from registration under the Investment Company Act of 1940, as amended (the “1940 Act”) and whose securities are not registered under the Securities Act of 1933, as amended (the “Securities Act”)

I am sure we’ll hear more about these files.

(3) Scandals for Right-wing Bloviators: It was satisfying to see a couple of right-wing douchebags get publicly shamed. First Fareed Zakaria was caught lifting (with minor paraphrase) a passage from a New Yorker article (here’s an early report from a NYT blog). Time and CNN suspended and then reinstated him, and he was supposedly exonerated (people are now talking about the “feeding frenzy” that was supposedly too hasty), but I don’t see why he is considered to be exonerated (and neither does this piece from the New York magazine website). All you have to do is apologize?

Then there was the bleechy Niall Ferguson’s fact-challenged cover article in Newsweek criticizing Obama, which Paul Krugman took down in his blog; Brad DeLong called for him to get fired. We learn from Huffington Post that Newsweek doesn’t actually fact-check: “we, like other news organisations today, rely on our writers to submit factually accurate material.” Wow.

That’s it for now.

–Chris Sturr