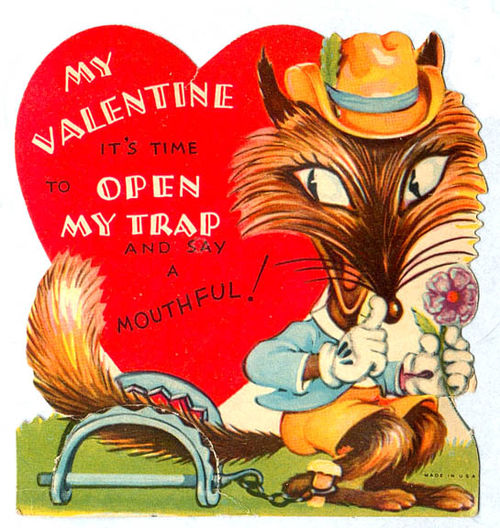

(1) Strange 1920s Valentines: For more like today's image, visit Retronaut (which is worth visiting anyway). I discovered these last year and sent myself an email to be delivered in time to post one for VDay this year.

(2) Minimum Wage: One of the highlights of the State of the Union was Obama's call for raising the minimum wage to $9/hour. (If only he would actually fight for that.) But why so low? In our July/August 2012 issue, Jeannette Wicks-Lim argued that the minimum wage could be raised at least 70%--to at least $12.70 an hour--without job loss or other downsides. I just posted the article here.

(3) Tax Rates: Earlier this week, I posted Jerry Friedman's Economy in Numbers, The Great Tax-Cut Experiment. (It also got picked up by Portside. If you like the article, please consider sharing it on Facebook or other social media sites using the "Share This" button to the top right of the page.) I have been meaning to post links to two nice posts by Barry Ritholtz (one from The Big Picture, one from Rubini's Economonitor, but I'm guessing reposted from The Big Picture). The one from The Big Picture, Who the Hell are Phil Michelson's Financial Advisors? takes down the whiny millionaire golfer's tax complaints. Ritholtz's point is that any rich person who claims to be paying a 63% tax rate is either lying or has very poor financial advice. He quotes from the hilarious Forbes piece making fun of Michelson (even the business press is making fun of the whiny millionaires these days, as when Bloomberg made fun of the banker Andrew Schiff who complained about how hard it was to live without his bonus). Forbes said this: "To be honest, it’s hard to blame Mickelson--who has compiled a net worth approaching $180 million by repeatedly striking a tiny white ball until it falls into a hole--for putting all options on the table, which according to some, include the possibility of prematurely shutting down his career to avoid his rising tax burden." Making fun of Michelson, ok; but Forbes making fun of golf?! Anyhow, Ritholtz's Economonitor post, Forgetting History: Value Creation and Tax Burdens, is also worth checking out, and is along the lines of Jerry's EIN: he points out that "a wealthy or even moderately well off American has the lowest Federal Tax burden in half a century." (Value creation has to be a touchy topic for people whose job is striking tiny white balls.)

(4) Mountaintop Removal Coal Mining and Public Health: Hat-tip to Jenny B. for letting us know about an important bill that has been introduced in the House, the Appalachian Community Health Emergency Act (H.R. 526), which aims to "to protect families and people across Appalachia from harmful impacts of an extreme form of coal mining called mountaintop removal mining. In mountaintop removal mining, explosives are used to blast apart mountaintops and extract coal, and the remaining rubble and waste is dumped into the streams and valleys below." My first article for D&S (co-written with former D&S book editor Amy Offner), Flattening Appalachia, was about mountaintop removal coal mining. More info about this bill from Earth Justice press room (I love their tagline: "The Earth Needs a Good Lawyer"). Maybe the coal companies will take a page from the gun manufacturers' book in blocking public-health studies of their industry: "Energy independence and freedom to extract resources are not a public-health issue!" (I've been hearing about how the gun manufacturers and the NRA have for years blocked any funding of the public health aspects of gun violence on the grounds that "Our 2nd Amendment rights are not a public-health issue!")

(5) Unaccountable Bankers: I've been meaning to link to several items on the topic of holding bankers accountable (or the government's failure to hold them accountable). One is Yves Smith's post at Naked Capitalism about the Congressional investigation, initiated by Elijah Cummings and Elizabeth Warren, into the foreclosure fraud settlement. A possibly hopeful development. Then there is Bill Black's post at Naked Capitalism on what he calls the "Banksters Immunity Doctrine." (Note the date-rape metaphor.) Then there are two videos I'd recommend; I'm just going to post them here. One is Rolling Stone's Matt Taibbi on Bill Moyers talking about big banks' lack of accountability:

The other video I think everyone should watch is Jon Stewart's hilarious takedown of HSBC and AIG:

The funniest part is where he is talking about how HSBC was found to have laundered money for drug runners and terrorists. Stewart says: "Drug runners and terrorists!? What are they doing hanging around with the likes of bankers?!"

That's all for now.

--Chris Sturr