This one is for the demise of (part of) DOMA; hat-tip to Patrick C. (New Hope Church is an actual church in Austin, Texas--I looked it up. )

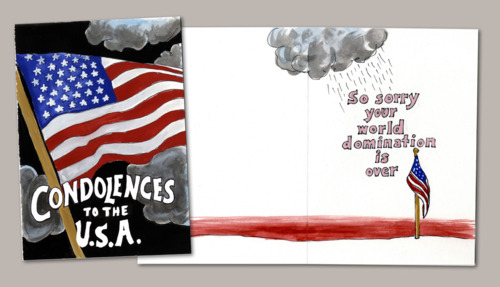

And these two for Independence day, both by Erika Rothenberg; the greeting card is a reprise from this post back in October 2011 (I've been thinking about it these days--it seems more applicable than ever!).

(1) The Times slanders MMT: The New York Times had an odd piece about Modern Monetary Theory on the front page of yesterday's business section, Warren Mosler, a Deficit Lover with a Following. Thing is, the article never bothers to explain what MMT is--it just does a profile of Mosler, a wealthy MMT supporter, maybe just so the reporter could visit him in St. Croix? I was suspicious as soon as I read the quote from Stephanie Kelton of the University of Missouri at Kansas City, a hotbed of MMT, in which she supposedly said that MMT is propounded on blogs but not in academic journals. I couldn't imagine her saying that, and if she did say something like that, I imagined that she would have also said all kinds of things to explain and defend MMT, though the article quotes nothing like that.

Sure enough, Kelton confirms in a comment on Dean Baker's blog post on the article that she was misquoted. Baker surmised that economist Mark Thoma was misquoted as calling MMT "nuts"; Kelton says:

Thanks, Dean. It is possible that Mark was taken out of context. The quote attributed to me wasn't remotely close to anything I actually said. The notion that MMT has no academic footprint is laughable. There are literally hundreds of articles in peer-reviewed journals, books, chapters in edited volumes, etc. This was a(nother) deliberate attempt to cast MMT as a kooky Internet phenomenon. Anyone else wonder why the NYT would send a reporter and a photographer all the way to St. Croix (yes, they physically went there) for a story about a silly little Internet theory? I suspect they know it's much more than that.

Yves Smith's take on the article in the Links section yesterday at Naked Capitalism is also good:

Warren Mosler, a Deficit Lover With a Following

What I found particularly outrageous was the idea that MMT is somehow the left equivalent or analog of wanting to return to the gold standard (as if there are any serious economists who think that is a good idea). Plus the whole condescending NYT treatment. We should have a piece on MMT in D&S soon, possibly in the Sept/Oct issue.

(2) Michael Hudson: Great piece from Michael Hudson at today's NC: From the Bubble Economy to Debt Deflation and Privatization. One nice thing about this piece is he contextualizes Wall Street's snookering of municipalities:

Carrying this debt overhead has caused a fiscal crisis. The financial and real estate bubble helped keep state and local finances solvent by providing capital gains taxes. These are now gone – and properties in default or foreclosure are not paying taxes. And whereas public pension funds assumed an 8+% rate of return, they now are making less than 1%. This has left pensions underfunded, and prompted some municipalities to engage in desperate gambles on derivatives. But the Wall Street casino always wins, and most cities have lost heavily to the investment banking sharpies advising them.

We covered this in our March/April 2012 cover story by Darwin BondGraham, with a special focus on Oakland. Darwin has a new piece on this in the East Bay Express: City Unions: Wall Street Looted Oakland.

(3) Juan Cole on Egypt: Hat-tip to T.M. for the best Egypt headline, from the NY Daily News: "MORSI BEAU COUP!" And here's Juan Cole, who turns out to tweet (and retweet) incessantly, I have noticed now that I'm trying to get into tweeting myself: How Egypt's Michelle Bachman Became President and Plunged the Country into Chaos.

(4) More on Global Protest: I read in the comments section of some article about Egypt a few days ago (after the Sunday protests, before the intervention of the army) a report from some U.S. professor who was in Egypt witnessing the protests claiming that there were 17 million people on the streets protesting. I haven't heard estimates of how many people are protesting, but I have heard other people say that between the protests in Egypt and those in Brazil, Turkey, Thailand, Hong Kong, and elsewhere, we may be seeing the largest number of humans protesting at the same time in human history. Two pieces that pick up on this idea:

- From Jeff Faux, Brazilian Protests: Could It Happen Here?

- From Margaret Flowers and Kevin Zeese, The Subjects of American Empire are Joining in Solidarity.

We will have a short comment on the Turkey protests in our July/August issue, by Armagan Gezici. On Brazil, James Cypher's feature in our March/April issue praised the "neo-develomentalism" of Lula and his successor Dilma Rousseff, but he also said, presciently:

At the broader societal level, if sports facilities for the 2014 World Cup and the 2016 Summer Olympics are viewed as crowding out crucial social needs—needs constantly highlighted by the progressive administrations in power since 2002—clashes over policy could escalate.

(5) Student Loans: There's a nice piece by William Greider in The Nation on the bill Elizabeth Warren has put forward for the government to give students the same rate they give to the big banks: Elizabeth Warren Tackles Wall Street.

Meanwhile, in Oregon, the legislature is advancing a system for funding state higher ed that would essentially eliminate tuition. Here's the NYT story on it: Oregon Looks at Way to Attend College Now and Repay Later. What's key is that repayment is based on a percentage of income, so students won't have to worry about debt peonage as they do now. Left economist Mary King of Portland State University was involved in developing the proposal (hat-tip to Steve Pressman for alerting me to this; King is quoted in the Times piece).

(6) Summer fundraiser: The example I gave of James Cypher's prescient remark in our March/April issue, essentially predicting unrest related to massive spending on stadiums, is related to the theme of this summer's "dry season" fundraiser: Help D&S Stay Ahead of the Curve. We have been keeping track of articles we've run that alert our readers to issues months ahead of when larger outlets start reporting them, e.g. the Cypher example, and our cover story in that same issue, about big-finance speculation in real estate (which has since been on the front page of the Times and also in other major outlets), and Ellen Frank's skepticism about Rogoff and Reinhart in her article about deficit scare-mongering (she said in our March/April issue that their 90% debt-to-GDP ratio figure, at which growth supposedly falls off a cliff seemed to be "pulled out of a hat"--a couple of months before their study was publicly discredited).

Please consider giving generously to our summer fundraiser to help us help you keep ahead of the curve. Donate here. If you feel like it, mention in the comments section of your order that you read the D&S blog.

--Chris Sturr