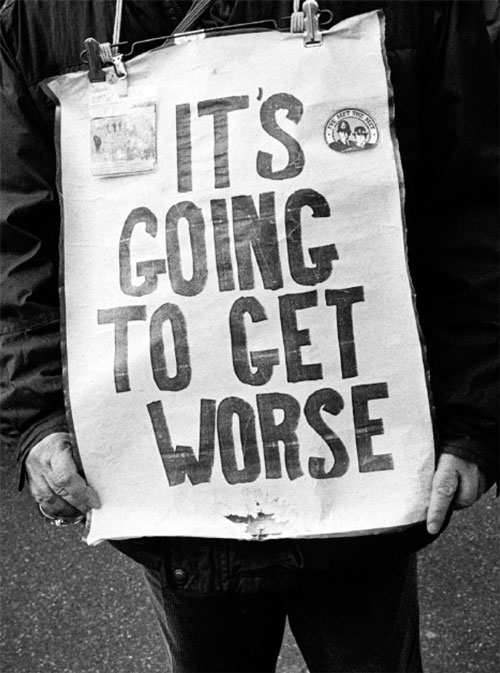

(1) Possibly Irrelevant Image:

Which New York Times article are we to believe?

(2) Bernanke Says Rising Wages Will Lift Spending, from yesterday's New York Times (check out the goofy pic of Geithner):

Ben S. Bernanke, the Federal Reserve chief, spoke in South Carolina.

...

While the United States has "a considerable way to go" for a full recovery, "rising demand from households and businesses should help sustain growth," Mr. Bernanke said on Monday in a speech in Charleston, S.C. "We are maintaining strong monetary policy support for the recovery," he said in response to an audience question, without discussing any further action the Fed could take to aid growth.

Read the full article.

or (3) More Workers Face Pay Cuts, Not Furloughs, from today's Times:

Local and state governments, as well as some companies, are squeezing their employees to work the same amount for less money in cost-saving measures that are often described as a last-ditch effort to avoid layoffs.

A new report on Tuesday showed a slight dip in overall wages and salaries in June, caused partly by employees working fewer hours.

Though average hourly pay is still higher than when the recession began, the new wage rollbacks feed worries that the economy has weakened and could even be at risk of deflation. That is when the prices of goods and assets fall and people withhold spending as they wait for prices to drop further, a familiar idea to those following the recent housing market.

The article includes a picture of a worker from the Mott's (apple juice) plant in Williamson, NY, where workers have gone on strike rather than accept pay cuts.

This article says that there's a risk of deflation, whereas the other article, from happier, more optimistic times (viz., earlier this week) has the goofy Geithner saying that the economy is “healing,” and that the economy is "in no danger of confronting a deflationary threat like the challenges that have faced the Japanese economy."

(4) Employers Strike--Because They Can, John Miller's column from the current issue of Dollars & Sense. Same reason they cut wages--unless the sisters and brothers at Mott's have something to say about it.

--Chris Sturr

PS: Ok, I couldn't resist Photoshopping today's Potentially Irrelevant Image with the goofy picture of Geithner:

I hope I'm not violating anyone's intellectual property rights...